The ability to tackle problems related to general aptitude is essential for anyone aiming to excel in competitive exams or enhance their everyday problem-solving skills. Calculating selling prices, particularly when losses are involved, is a core concept that bridges theoretical knowledge with practical application. It's a skill that empowers you to navigate financial scenarios with confidence and precision.

On This Page

Read More

Understanding and mastering concepts related to general aptitude is crucial for success in various competitive exams and real-world problem-solving scenarios. Calculating the selling price of an item when a loss is incurred is a fundamental aspect of general aptitude and everyday financial literacy. This article explores how to calculate the selling price with a 20% loss, providing step-by-step explanations and practical examples to enhance your understanding.

Calculating Selling Price: The Basics

The ability to calculate the selling price, considering a loss, is a fundamental skill in general aptitude. It is a concept that helps in understanding how business transactions work. The selling price calculation is not just limited to textbooks; it has real-world applications in your day-to-day transactions.

Understanding Cost Price and Loss Percentage

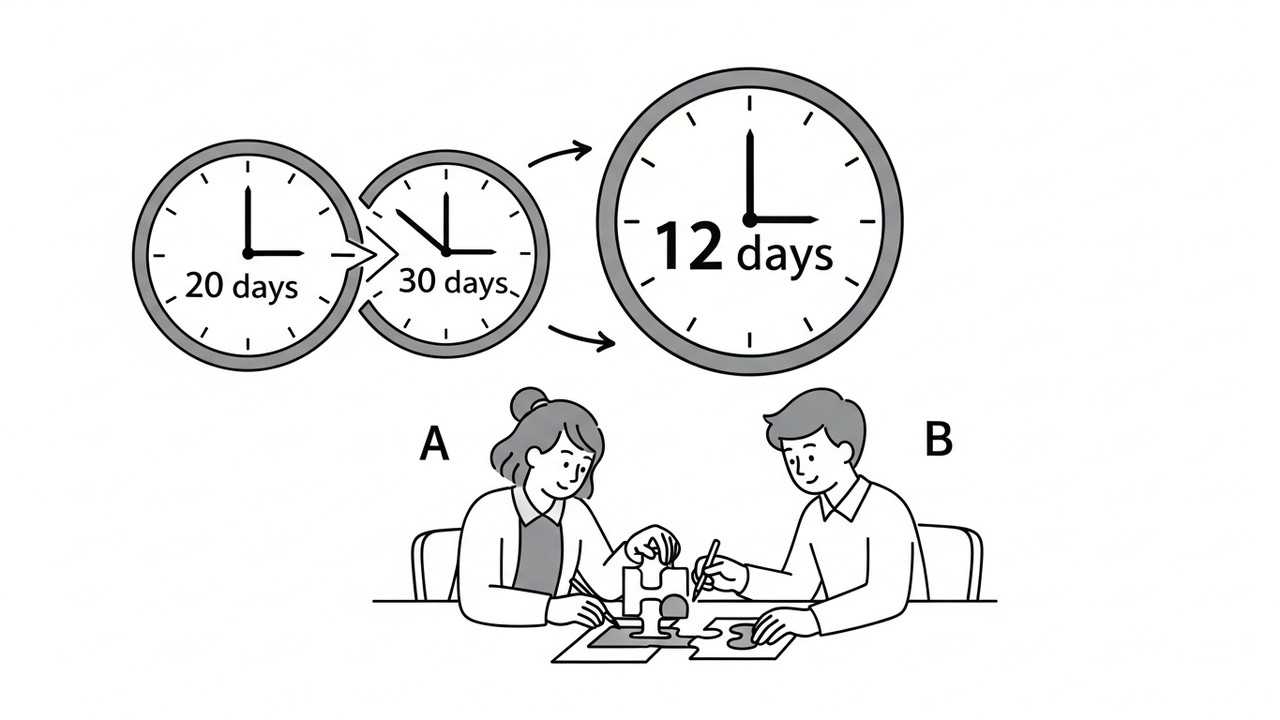

The cost price (CP) is the price at which an item is bought, and the loss is the amount by which the selling price (SP) is less than the cost price. The loss percentage is the loss expressed as a percentage of the cost price. For example, if an item is bought for ₹300 and sold at a loss of ₹60, the loss percentage is ##(60/300) * 100 = 20%##. This means that for every ₹100 spent, ₹20 was lost.

To calculate the selling price when there is a loss, you must know the cost price and the loss percentage. The formula to calculate the selling price is: SP = CP – Loss, where Loss = (Loss Percentage / 100) * CP. It is very important to have a clear understanding of the terms used in this calculation. The cost price is the base value upon which the loss is calculated.

Let us carefully analyze the given scenario to understand the concept of loss in a transaction:

Calculation of Loss

The shopkeeper purchases a product at a Cost Price (CP) of ₹500 and sells it at a loss of 10%. The formula to calculate loss is:

Loss Formula

### \text{Loss} = \dfrac{\text{Loss %}}{100} \times \text{Cost Price} ###

Substituting the values:

### \text{Loss} = \frac{10}{100} \times 500 = 50 ###

Selling Price

The Selling Price (SP) is obtained by subtracting the loss from the cost price:

### \text{SP} = \text{CP} - \text{Loss} = 500 - 50 = 450 ###

This clearly shows that the shopkeeper sold the item at ₹450, incurring a direct loss of ₹50.

Interpretation

This calculation highlights the importance of analyzing losses. Even a small percentage loss can significantly affect the final selling price. Such evaluations are crucial for shopkeepers to make informed decisions regarding pricing, discounts, and profit margins.

Summary Table

| Cost Price (CP) | Loss % | Loss Amount | Selling Price (SP) |

|---|---|---|---|

| ₹500 | 10% | ₹50 | ₹450 |

Additional Example

Suppose a shopkeeper buys a product at ₹800 and incurs a loss of 15%. Let us calculate:

### \text{Loss} = \frac{15}{100} \times 800 = 120 ###

### \text{SP} = 800 - 120 = 680 ###

| Cost Price (CP) | Loss % | Loss Amount | Selling Price (SP) |

|---|---|---|---|

| ₹800 | 15% | ₹120 | ₹680 |

Through such examples, one can develop a strong grasp of how percentage loss translates into real monetary values, which is vital in commerce and trade.

Calculating Selling Price with a 20% Loss

Let’s dive into a practical example. Suppose a trader purchases goods for ₹800 and subsequently sells them at a 20% loss. To determine the selling price, we first calculate the loss amount. The loss is 20% of ₹800, which is ##(20/100) * 800 = 160##. The selling price is obtained by subtracting the loss from the cost price, resulting in ##800 - 160 = 640##. Thus, the selling price of the goods is ₹640.

This calculation is crucial in various commercial contexts. In real-world scenarios, understanding the impact of loss helps in setting prices and managing inventory efficiently. For instance, a retailer might use this calculation to price a product, ensuring they do not incur a loss, or can plan for a loss. This simple formula can be used for various items in different settings.

Consider another scenario: a seller buys an item for ₹1000 and sells it at a 20% loss. The loss is ##(20/100) * 1000 = 200##. The selling price will be ##1000 - 200 = 800##. This calculation is very straightforward and is used in all types of trade and commerce.

Solving Problems Involving Loss and Selling Price

Tackling problems involving loss and selling price is a key component of general aptitude assessments. These problems test your ability to apply the formulas and understand the relationships between cost price, selling price, and loss percentage. By practicing a variety of problems, you can improve your skills in these calculations.

Worked Examples

Consider an example: A shopkeeper buys a product for ₹350 and sells it at a 20% loss. What is the selling price? First, calculate the loss: ##(20/100) * 350 = 70##. Then, subtract the loss from the cost price: ##350 - 70 = 280##. Therefore, the selling price is ₹280. This is a step-by-step approach to solve a similar problem.

Another example: An item is purchased for ₹600 and sold at a loss. If the selling price is ₹480, what is the loss percentage? First, calculate the loss: ##600 - 480 = 120##. Then, calculate the loss percentage: ##(120/600) * 100 = 20%##. So, the loss percentage is 20%. This is an example of how to solve a problem where you are required to find the loss percentage.

Suppose an item is sold for ₹720, incurring a 20% loss. What was the cost price? Let the cost price be CP. The loss is 20% of CP. So, SP = CP - 0.20 CP. Therefore, ##720 = 0.80 \times CP##. Solving for CP, ##CP = 720/0.80 = 900##. Thus, the cost price was ₹900. This demonstrates how to work backwards from the selling price to find the cost price.

Practical Applications of Selling Price Calculations

Understanding how to calculate the selling price is crucial in various real-world scenarios. For instance, consider a small business owner who needs to determine the selling price of a product to avoid losses. By understanding the cost price and loss percentage, they can set a price that covers their costs and ensures profitability, if they choose to do so.

Moreover, this concept is essential for personal finance. When selling used items, such as a car or furniture, you must calculate the selling price to avoid a loss. The ability to accurately assess these calculations can help in making informed financial decisions. For example, if you sell an item for ₹1000, but bought it for ₹1200, you know you have incurred a loss.

In addition to business and personal finance, this concept applies to investment decisions. Investors often need to assess the potential loss when selling stocks or other assets. This skill helps them to make informed decisions and manage their investments effectively. By understanding the calculations, investors can manage risks and strategize their investments.

Key Takeaways

Mastering the calculation of selling price, especially when considering losses, is a fundamental skill in general aptitude. It enhances your ability to make informed financial decisions and solve real-world problems. By understanding the formulas and practicing various examples, you can confidently tackle problems related to cost price, selling price, and loss percentage.

The applications of these calculations are diverse, ranging from personal finance to business management. Whether you are setting prices for a product, assessing the value of a used item, or managing investments, the ability to calculate selling price with a loss is an invaluable asset. This knowledge not only helps in academic settings but also equips you with the tools needed for success in various aspects of life.

In conclusion, the selling price calculation is a very important concept for everyone. It is not just about solving questions; it is about real-world application. So, keep practicing these calculations, and you will improve your financial acumen.

| Item | Cost Price (₹) | Loss Percentage (%) | Loss Amount (₹) | Selling Price (₹) |

|---|---|---|---|---|

| Book | 240 | 20 | 48 | 192 |

| Example 1 | 300 | 10 | 30 | 270 |

| Example 2 | 500 | 20 | 100 | 400 |

We also Published

RESOURCES

- General Aptitude Test - Aptitude-test.com

- General Aptitude Contract : r/AirForceRecruits

- The role of mind-wandering in measurements of general aptitude

- General Aptitude : r/AirForceRecruits

- Fairness in Employment Testing: Validity Generalization, Minority ...

- GA General Aptitude

- ED164579 - Manual for the USES General Aptitude Test ... - ERIC

- Aptitude Questions and Answers - GeeksforGeeks

- Does anyone have General Aptitude in the Air Force?

- Fairness in employment testing: Validity generalization, minority ...

0 Comments